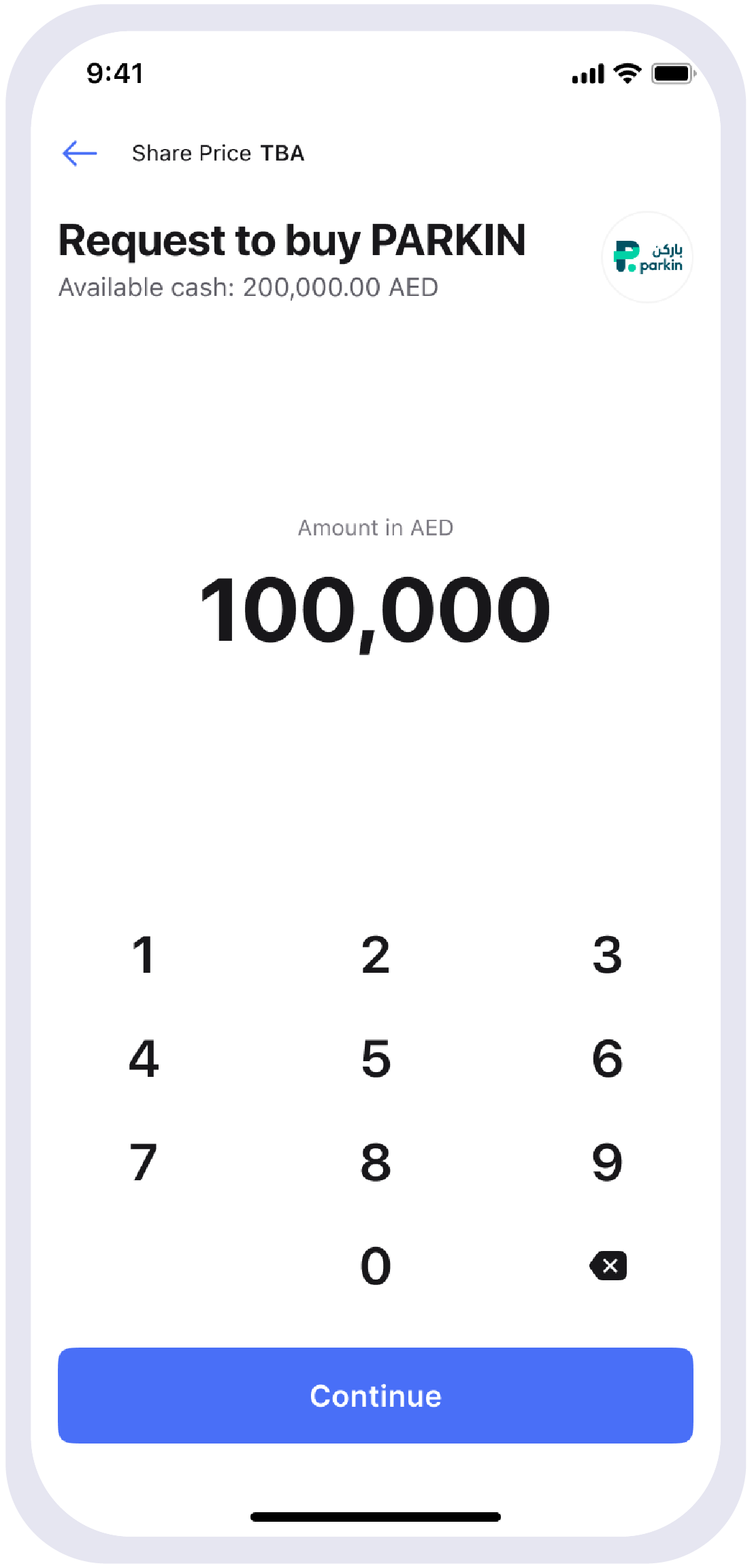

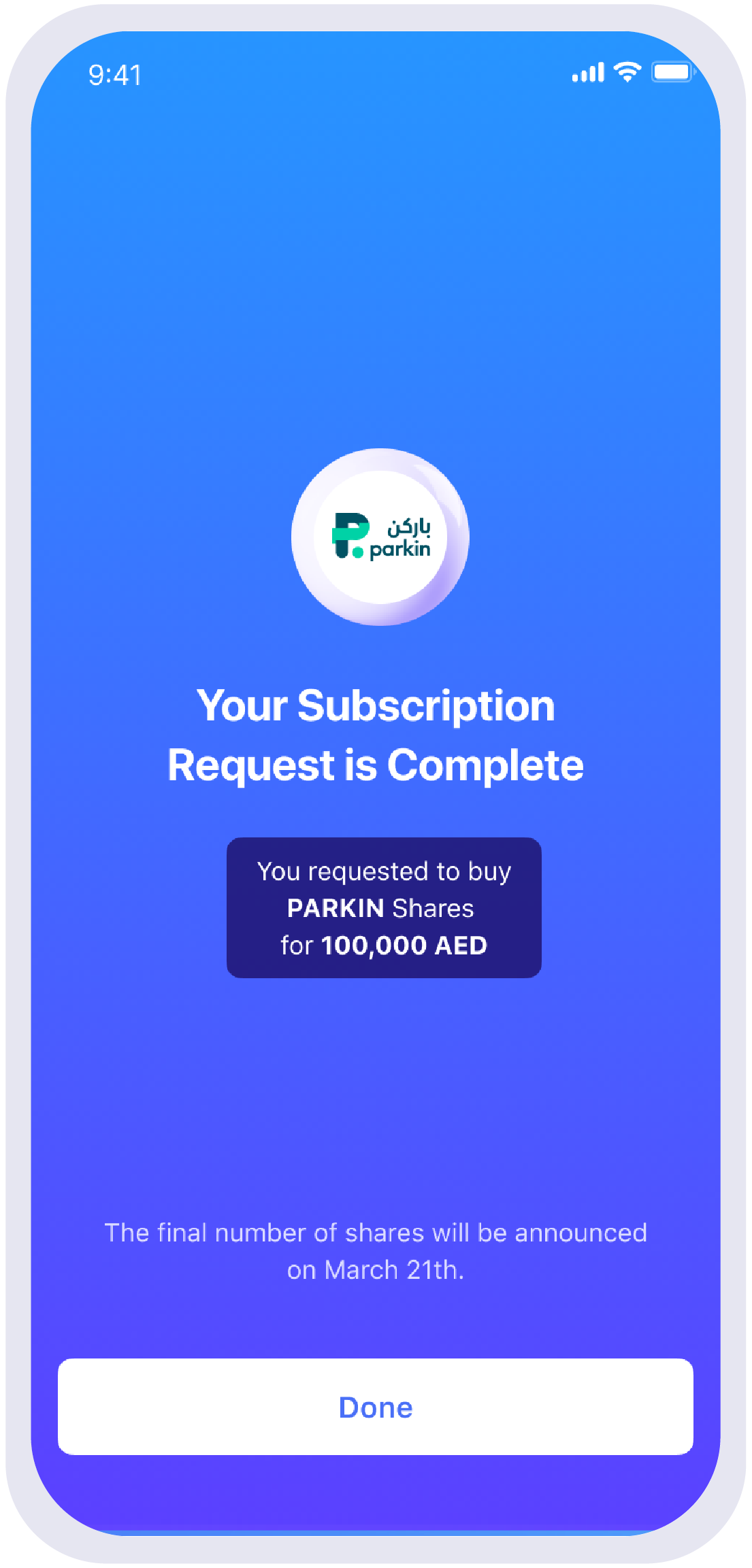

Parkin IPO

Parkin is the largest provider of paid parking facilities and services in Dubai, accounting for more than 90% of Dubai’s on-and-off street paid parking market.

Parkin currently operates 179,000 parking spaces across 85 locations in Dubai. The company closed 2023 with Dh779.4 million in revenues and the 2023 EBITDA was Dh414.4 million.

Parkin announced their intention to offer 749,700,000 shares representing 24.99% of their share capital, through an IPO on the Dubai Financial Market.