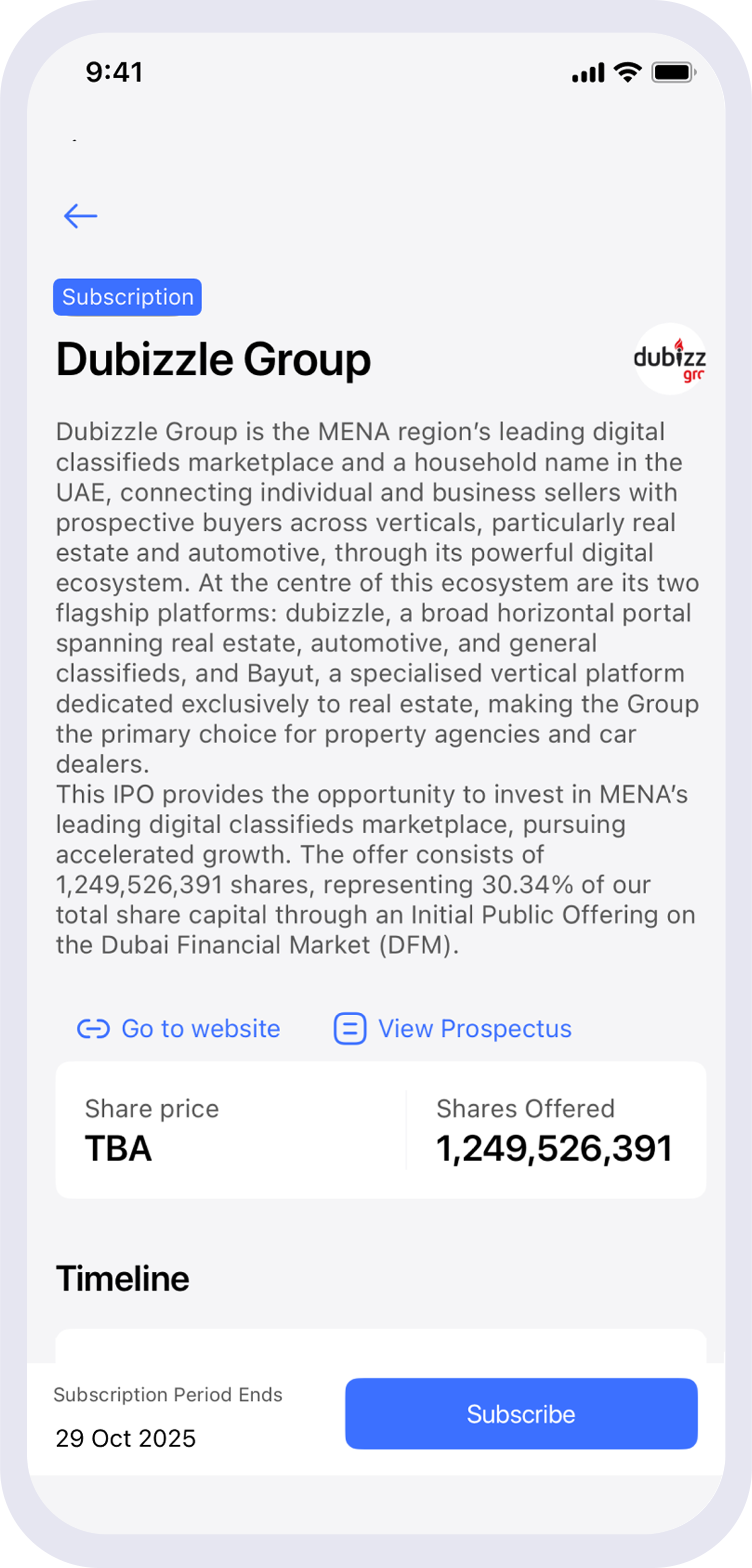

Company Overview

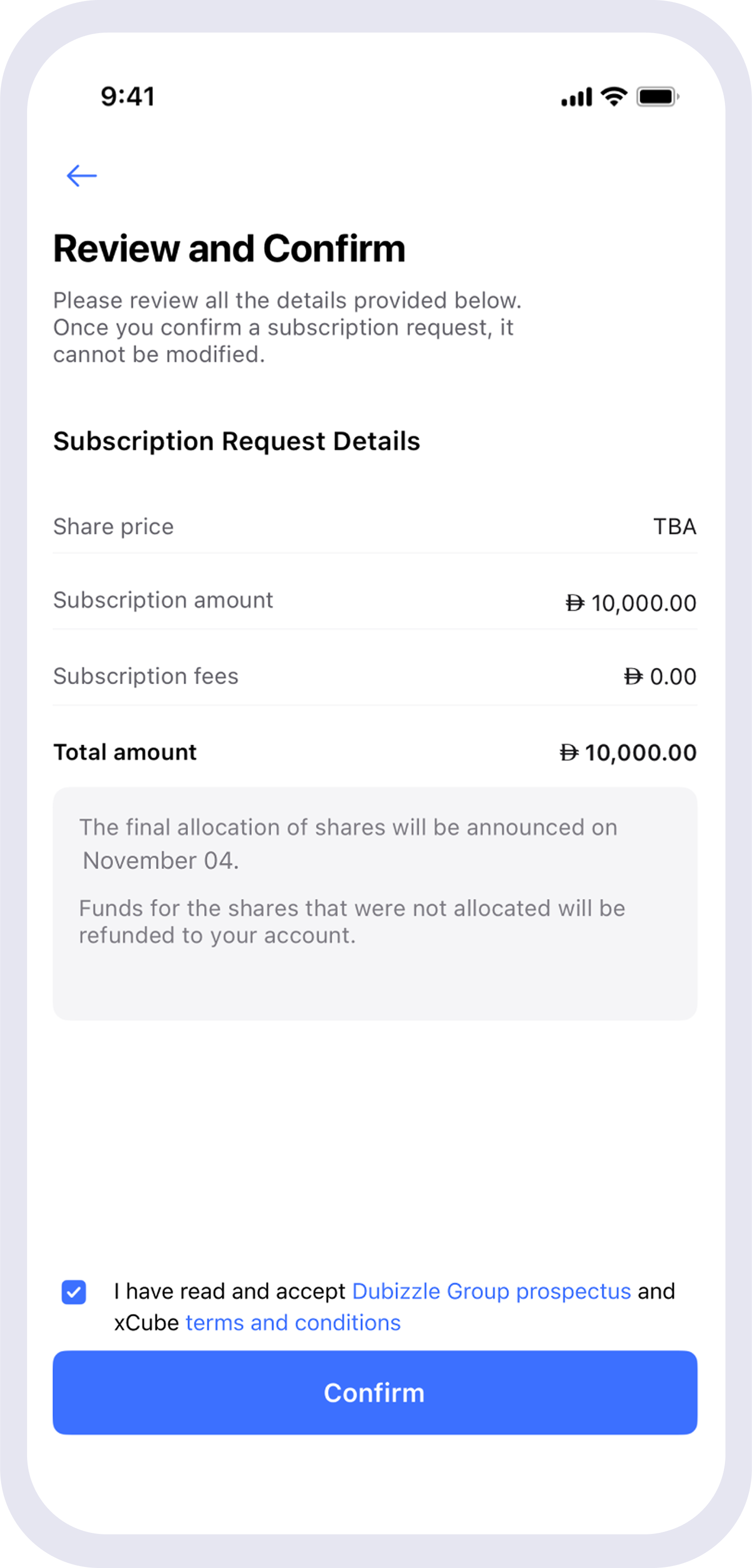

Dubizzle Group, the MENA region's premier digital classifieds company, is pleased to announce its intention to proceed with an Initial Public Offering (IPO) on the Dubai Financial Market (DFM). The Company will offer 1,249,526,391 ordinary shares, equivalent to 30.34% of its total share capital.

This IPO presents a strategic opportunity to invest in a proven market leader with a powerful dual-platform ecosystem: dubizzle, a broad horizontal marketplace, and Bayut, a dedicated real estate vertical. The Group is the primary partner for property agencies and automotive dealers, positioning it for accelerated growth.