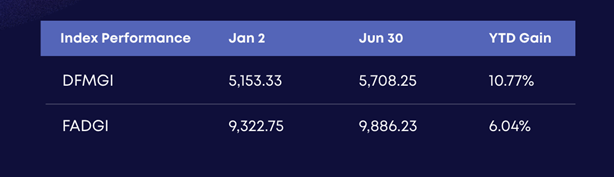

The first half of 2025 marked a breakout period for UAE capital markets. The DFMGI rose 10.77% to close at 5,708.25, led by blue-chip earnings, record land deals, and MSCI rebalancing flows. FADGI climbed 6.04% to 9,886.23, fueled by banking sector momentum, ADNOC’s global expansion push, and improved investor sentiment in infrastructure and energy.

Both indices overcame a sharp mid-June pullback driven by geopolitical risk, closing the half soaring past 52-week highs. This report outlines the key price movements, earnings trends, sectoral drivers, capital flows, and macro themes that shaped the UAE’s equity landscape in H1 2025.